The złoty is the most expensive in real terms since 2008. "20 percent above the multi-year average"

The latest BIS (Bank for International Settlements) data show that in April the so-called real effective exchange rate of the PLN (REER) moved down from its highest level since 2008. The April correction of the złoty was not particularly large (only -0.6% in terms of REER), but it was enough to bring the real exchange rate to its lowest level in four months.

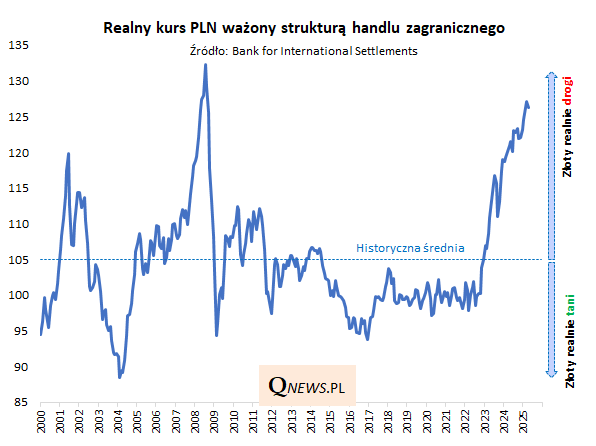

The chart below provides a long-term context for the current situation, which we have written about before. In fundamental terms, the Polish currency is very expensive (the April correction did little to change this). It was as expensive as before only for a few months in 2008. Suffice it to say that the REER rate is still 20% above its multi-year average.

The real effective exchange rate (REER) shows the strength of a currency in fundamental terms, taking into account differences in inflation between countries and the structure of foreign trade - this is the approach preferred by economic theory.

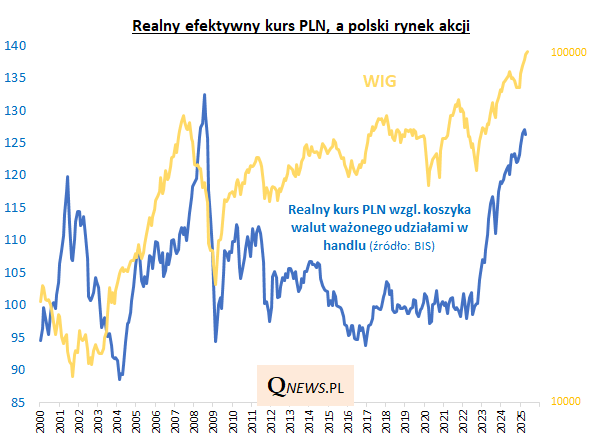

AdvertisementCan you find any correlation between this measure of currency strength and Polish assets, such as the stock market? Let's take a look at the chart below.

It is striking that the impressive bull market on the WSE, which has been going on since autumn 2022, was accompanied by an equally spectacular increase in the real PLN exchange rate. It is true that this real appreciation of our currency was partly due to the inflation effect (especially since the outbreak of the pandemic, inflation in Poland has been persistently higher than, for example, in the euro zone), but to a large extent it was also probably the result of capital inflows. And from there, it is a direct path to explaining the bull market on the WSE.

The high level of the real effective PLN exchange rate may be worrying, however, because historically this exchange rate could collapse suddenly from such high levels (2008, 2001-03), which was accompanied by strong turbulence on the domestic stock exchange (another matter is that after such a collapse, the cheap PLN turned out to be the fuel for another bull market thanks to, among other things, its positive impact on exports).

In other words, the matter undoubtedly requires urgent observation. The spectacular real appreciation of the złoty since autumn 2022 has its positive aspects (it accompanied a strong bull market on the WSE), but the levels to which the PLN exchange rate has reached seem quite risky in the long run.

Author: Tomasz Hońdo, CFA, Quercus TFI SA

bankier.pl